January 2025 Bill Calendar: A Comprehensive Guide

Related Articles: January 2025 Bill Calendar: A Comprehensive Guide

- Calendario 2025 Para Escribir: Una Guía Integral

- December 2025 Calendar Horse: Characteristics, Personality, And Destiny

- Crop Over Calendar 2025: A Comprehensive Guide To Barbados’ Biggest Festival

- October 2025 Calendar

- 2025 Calendar With Federal Holidays: A Comprehensive Guide

Introduction

With great pleasure, we will explore the intriguing topic related to January 2025 Bill Calendar: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about January 2025 Bill Calendar: A Comprehensive Guide

January 2025 Bill Calendar: A Comprehensive Guide

Introduction

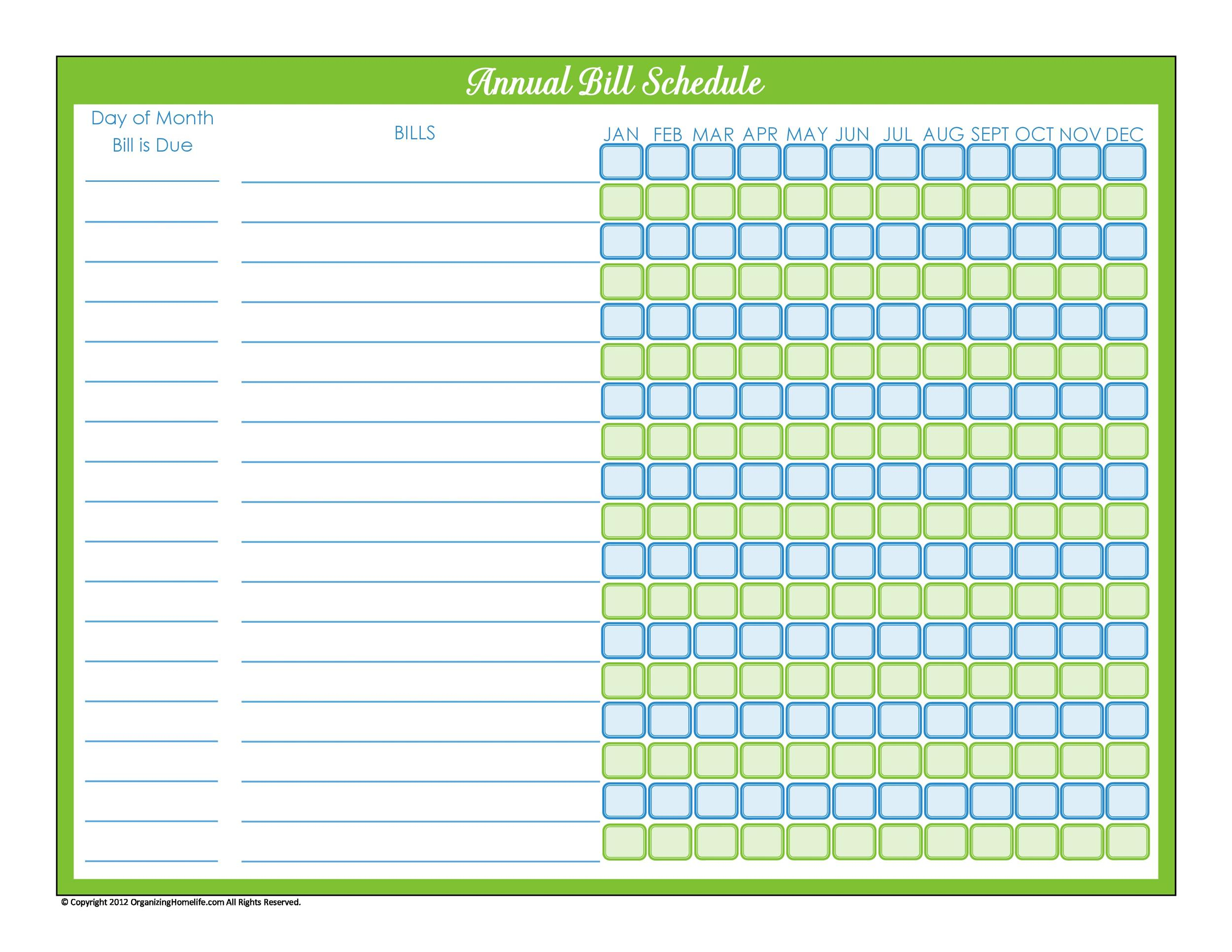

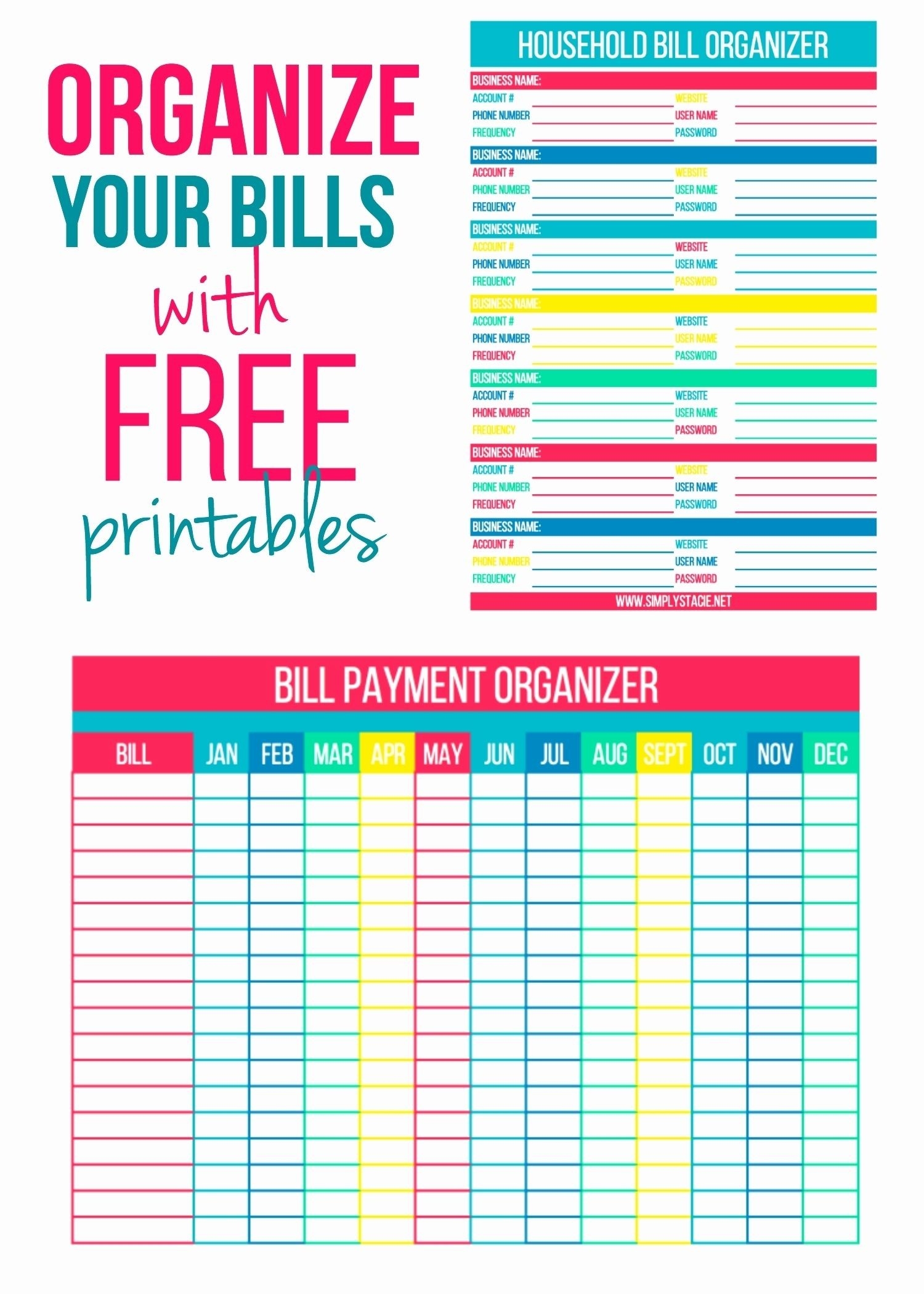

Managing finances effectively requires meticulous planning and organization. One of the essential aspects of financial management is keeping track of upcoming bills to ensure timely payments and avoid late fees. A bill calendar serves as an invaluable tool for this purpose, providing a clear overview of all pending financial obligations. This article presents a comprehensive January 2025 bill calendar, detailing due dates, payment amounts, and other relevant information.

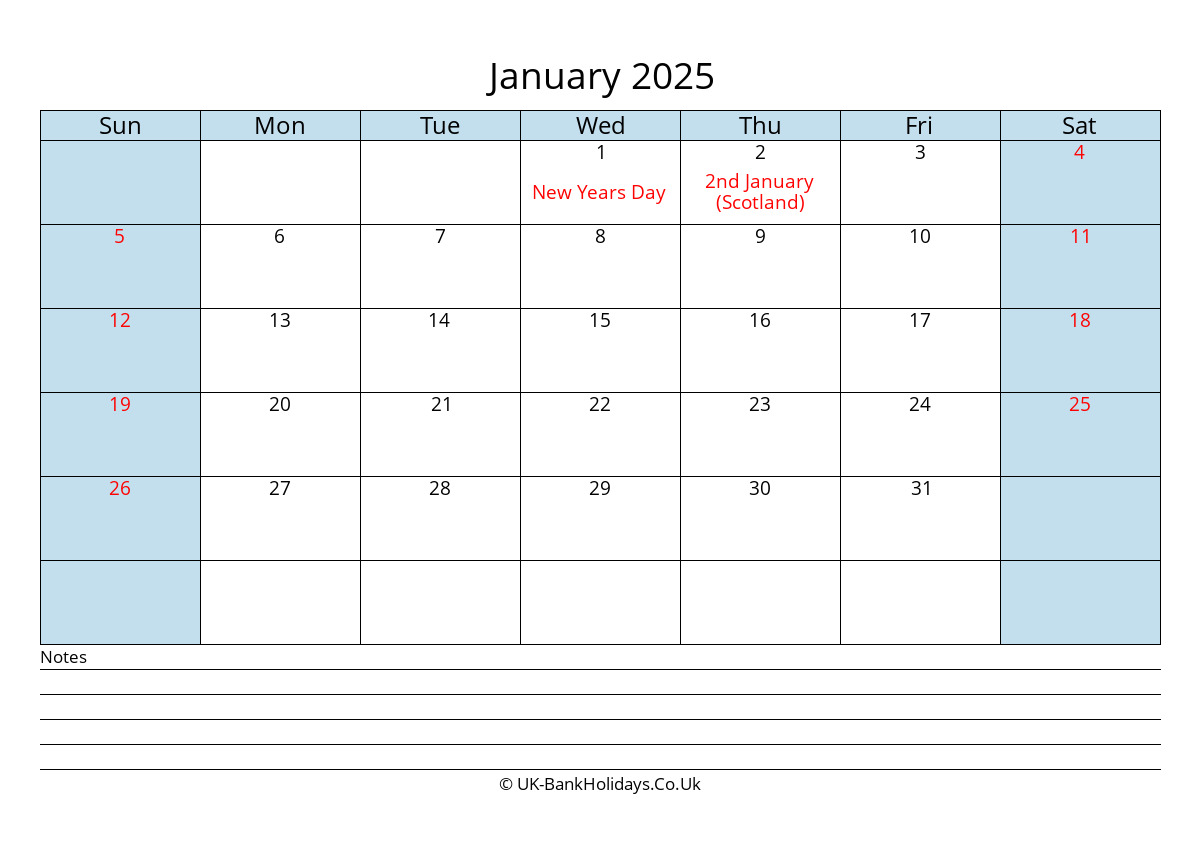

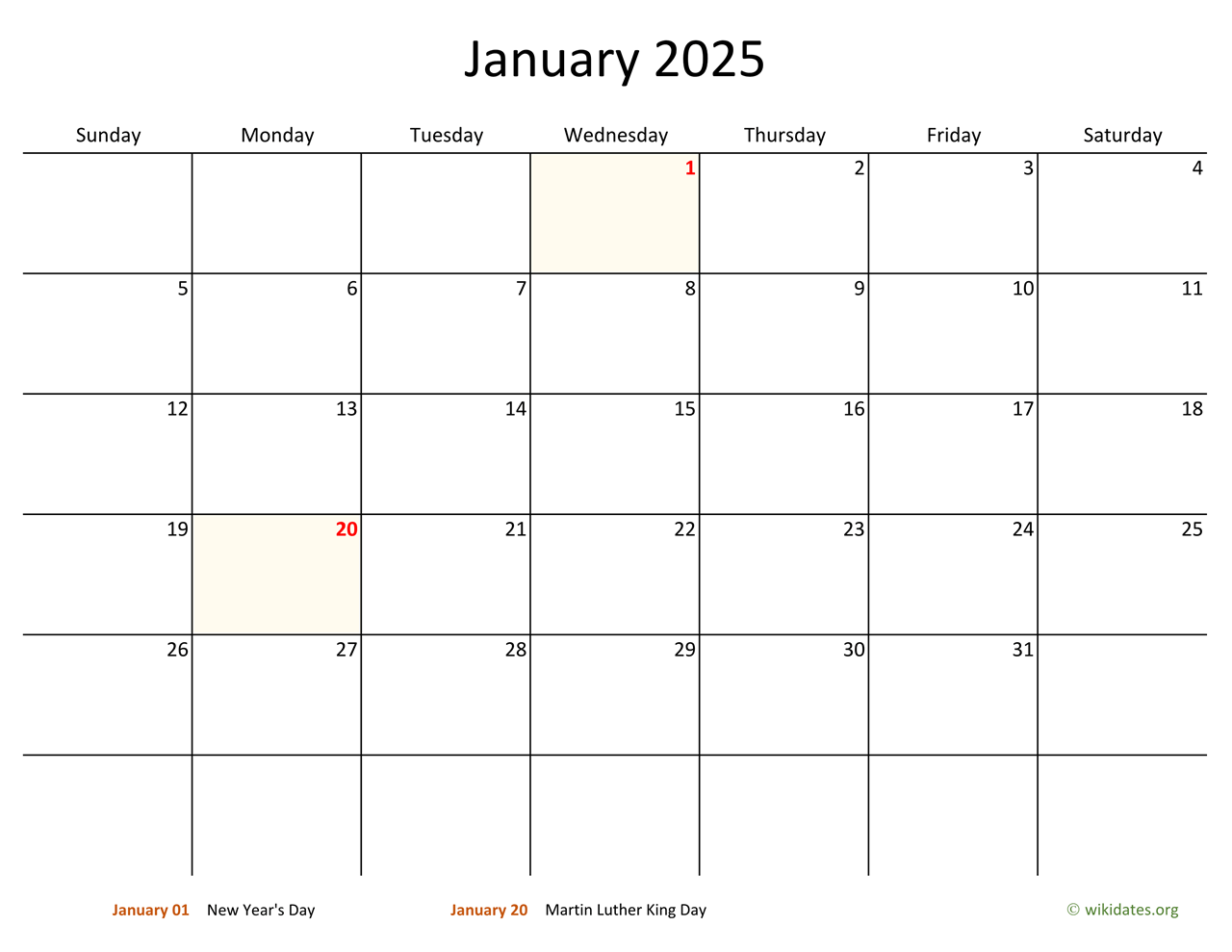

Calendar Format

The January 2025 bill calendar is presented in a tabular format, with each day of the month listed in a separate row. The following columns are included in the calendar:

- Date: The date of the month on which the bill is due.

- Bill Type: The type of bill, such as rent, utilities, credit card, or loan payment.

- Description: A brief description of the bill, including the account number or other identifying information.

- Due Date: The date by which the bill must be paid to avoid late fees or other penalties.

- Payment Amount: The total amount due for the bill.

- Notes: Any additional notes or reminders related to the bill.

Bill Calendar Entries

The January 2025 bill calendar includes entries for the following common types of bills:

- Rent: Typically due on the 1st of the month.

- Utilities: Electricity, gas, water, and trash removal bills are usually due around the middle of the month.

- Credit Card: Payments are typically due on or around the statement date.

- Loan Payments: Car loans, student loans, and other loan payments are often due on a specific day of the month.

- Insurance Premiums: Homeowners insurance, auto insurance, and health insurance premiums may be due monthly or quarterly.

- Other Bills: This category includes any other regular expenses, such as subscriptions, memberships, or childcare costs.

Example Entries

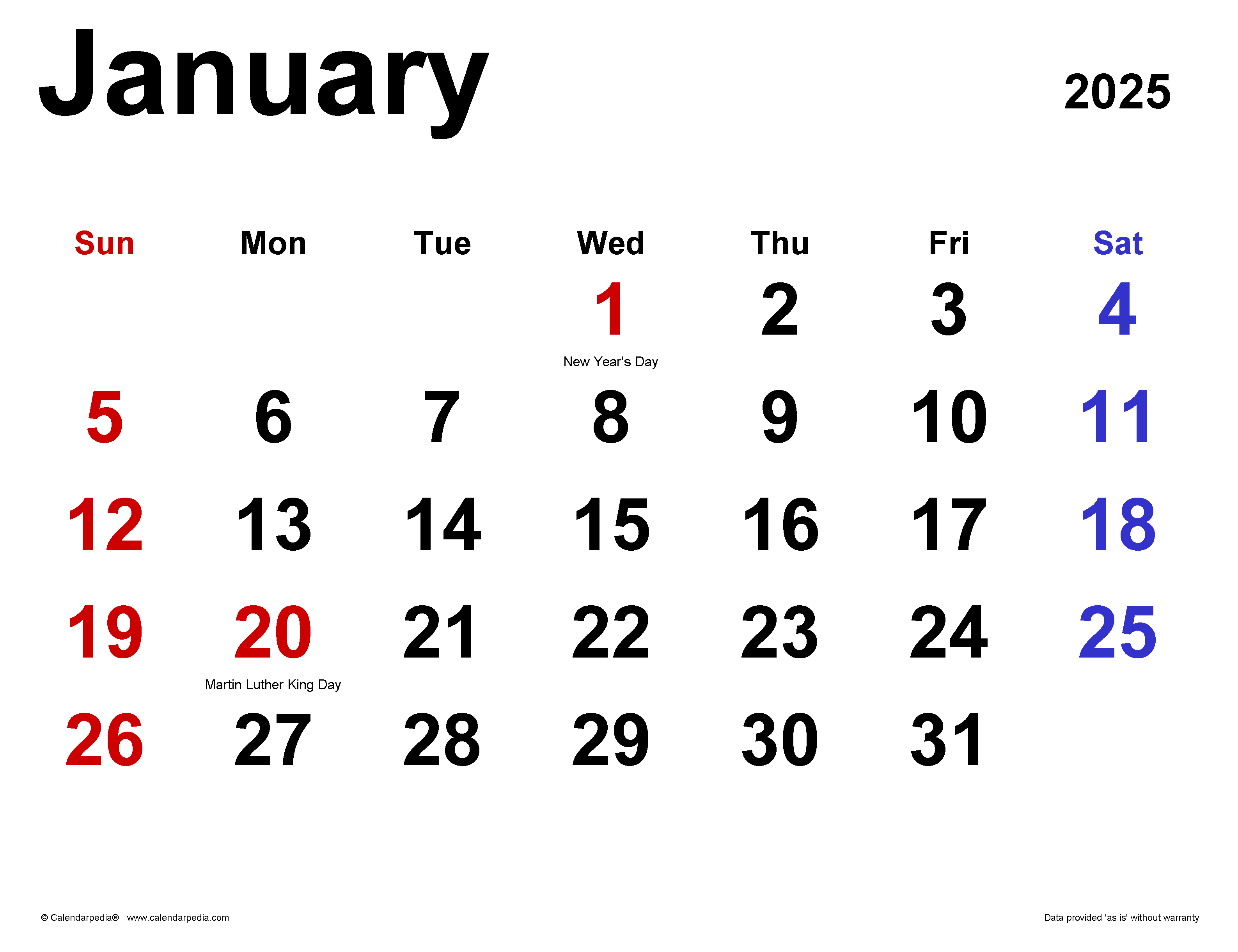

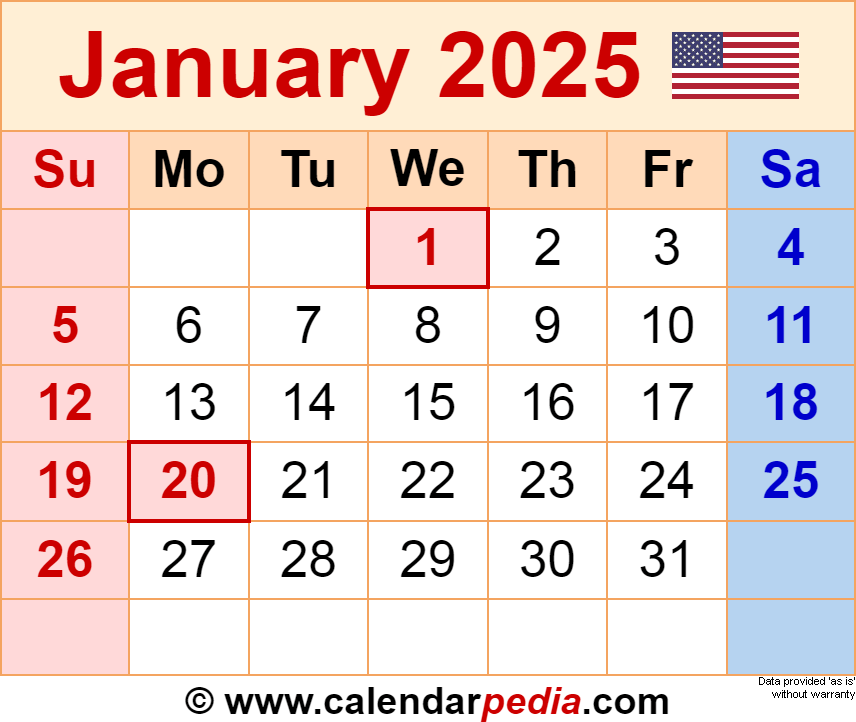

Here are a few example entries from the January 2025 bill calendar:

-

Date: January 1st

-

Bill Type: Rent

-

Description: Apartment rent for January

-

Due Date: January 1st

-

Payment Amount: $1,200

-

Notes: None

-

Date: January 15th

-

Bill Type: Electricity

-

Description: Electricity bill for December

-

Due Date: January 15th

-

Payment Amount: $150

-

Notes: None

-

Date: January 25th

-

Bill Type: Credit Card

-

Description: Credit card statement for January

-

Due Date: January 25th

-

Payment Amount: $300

-

Notes: Minimum payment required

Benefits of Using a Bill Calendar

Using a bill calendar offers numerous benefits for managing finances effectively:

- Improved Organization: A bill calendar provides a centralized location to track all upcoming bills, eliminating the need for multiple reminders or spreadsheets.

- Timely Payments: By having a clear overview of due dates, you can ensure timely payments to avoid late fees and protect your credit score.

- Budgeting: A bill calendar helps you plan your budget more effectively by knowing exactly how much you need to allocate for bills each month.

- Reduced Stress: Knowing that your bills are organized and under control can reduce financial stress and provide peace of mind.

- Improved Financial Health: Timely bill payments contribute to a healthy financial profile, helping you build a positive credit history and avoid debt.

Tips for Using a Bill Calendar

To maximize the benefits of a bill calendar, follow these tips:

- Keep it Up-to-Date: Regularly review your bill calendar and update it with any changes in due dates or payment amounts.

- Set Reminders: Set reminders on your phone or calendar to notify you of upcoming bills.

- Automate Payments: If possible, set up automatic payments for recurring bills to ensure they are paid on time.

- Review Bills Carefully: Before making any payments, carefully review bills for accuracy and any potential errors.

- Keep Receipts: Keep receipts or transaction records for all bill payments as proof of payment.

Conclusion

The January 2025 bill calendar is an essential tool for managing your finances effectively. By keeping track of upcoming bills, you can ensure timely payments, avoid late fees, and improve your overall financial health. By following the tips outlined in this article, you can maximize the benefits of using a bill calendar and achieve financial success.

Closure

Thus, we hope this article has provided valuable insights into January 2025 Bill Calendar: A Comprehensive Guide. We hope you find this article informative and beneficial. See you in our next article!