EY Payroll Calendar 2025: A Comprehensive Guide for Businesses

Related Articles: EY Payroll Calendar 2025: A Comprehensive Guide for Businesses

- November 2025 Calendar: Important Days

- Tea Time Calendar 2025: A Journey Through The World Of Tea

- 2025 Philippines Calendar PDF: A Comprehensive Guide To Filipino Holidays And Observances

- June 2025 Calendar With Holidays Philippines

- Academic Calendar 2025 Template Ireland

Introduction

With great pleasure, we will explore the intriguing topic related to EY Payroll Calendar 2025: A Comprehensive Guide for Businesses. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about EY Payroll Calendar 2025: A Comprehensive Guide for Businesses

EY Payroll Calendar 2025: A Comprehensive Guide for Businesses

Introduction

In today’s fast-paced business environment, payroll processing is an integral part of any organization’s operations. Ensuring timely and accurate payroll disbursement is crucial for employee morale, compliance with legal regulations, and maintaining a positive cash flow. To facilitate seamless payroll processing, businesses rely on payroll calendars, which provide a structured schedule for payroll activities throughout the year.

Understanding the EY Payroll Calendar 2025

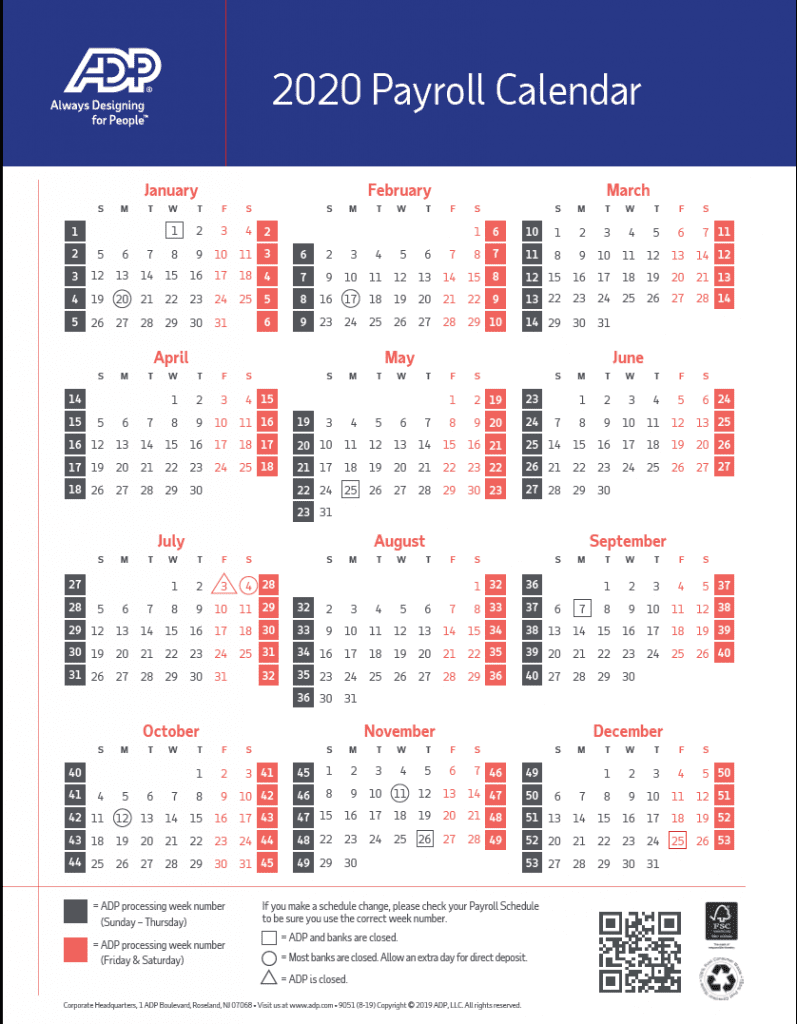

The EY Payroll Calendar 2025 is a comprehensive resource designed to assist businesses in planning and executing their payroll processes effectively. It outlines the key payroll dates, including payday, payroll cutoff, and tax filing deadlines, for the entire year 2025.

Key Features of the EY Payroll Calendar 2025

- Comprehensive coverage: The calendar includes all relevant payroll dates for the year 2025, including federal holidays, bank holidays, and state-specific holidays.

- Easy-to-read format: The calendar is presented in a clear and concise format, making it easy to navigate and identify important dates.

- Color-coded sections: Different payroll activities are color-coded for quick reference, allowing businesses to easily distinguish between payday, payroll cutoff, and tax filing deadlines.

- Printable and downloadable: The calendar can be printed or downloaded for easy access and distribution within the organization.

Benefits of Using the EY Payroll Calendar 2025

- Improved payroll accuracy: By following the payroll calendar, businesses can ensure that payroll is processed on time and accurately, reducing the risk of errors and penalties.

- Enhanced employee satisfaction: Employees appreciate timely and accurate payroll disbursement, which contributes to a positive work environment and increased productivity.

- Compliance with legal regulations: The calendar helps businesses stay up-to-date with payroll-related laws and regulations, minimizing the risk of non-compliance and potential fines.

- Optimized cash flow management: By planning payroll activities in advance, businesses can forecast their cash flow needs and allocate resources accordingly.

Detailed Overview of the EY Payroll Calendar 2025

The EY Payroll Calendar 2025 includes the following key dates:

- Payday: The day on which employees receive their wages or salaries.

- Payroll cutoff: The last day on which employees can submit timesheets or other payroll-related information for the current pay period.

- Tax filing deadlines: The dates by which various payroll-related tax forms must be filed with the relevant authorities.

Additional Resources for Payroll Management

In addition to the EY Payroll Calendar 2025, businesses can access a range of resources to further support their payroll management processes:

- EY Payroll Services: EY offers a comprehensive suite of payroll services, including payroll processing, tax compliance, and HR administration.

- EY Payroll Calculator: This online tool allows businesses to estimate their payroll costs and withholding amounts.

- EY Payroll Blog: The EY Payroll Blog provides insights and updates on the latest payroll-related laws, regulations, and best practices.

Conclusion

The EY Payroll Calendar 2025 is an invaluable resource for businesses of all sizes. By adhering to the payroll dates outlined in the calendar, businesses can streamline their payroll processes, enhance employee satisfaction, ensure compliance with legal regulations, and optimize their cash flow management. To further enhance their payroll management capabilities, businesses are encouraged to explore the additional resources provided by EY.

Closure

Thus, we hope this article has provided valuable insights into EY Payroll Calendar 2025: A Comprehensive Guide for Businesses. We appreciate your attention to our article. See you in our next article!