Calendario 2025 Renta Persona Natural: A Comprehensive Guide for Natural Persons

Related Articles: Calendario 2025 Renta Persona Natural: A Comprehensive Guide for Natural Persons

- 2025 Formula 1 Calendar With Timetables

- Free Printable Monthly Calendar March 2025: Plan Your Month Effectively

- Penn State Fall 2025 Academic Calendar: A Comprehensive Guide

- Greek Orthodox Lent Calendar 2025: A Comprehensive Guide

- 2025 Year-at-a-Glance Calendar

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Calendario 2025 Renta Persona Natural: A Comprehensive Guide for Natural Persons. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about Calendario 2025 Renta Persona Natural: A Comprehensive Guide for Natural Persons

Calendario 2025 Renta Persona Natural: A Comprehensive Guide for Natural Persons

Introduction

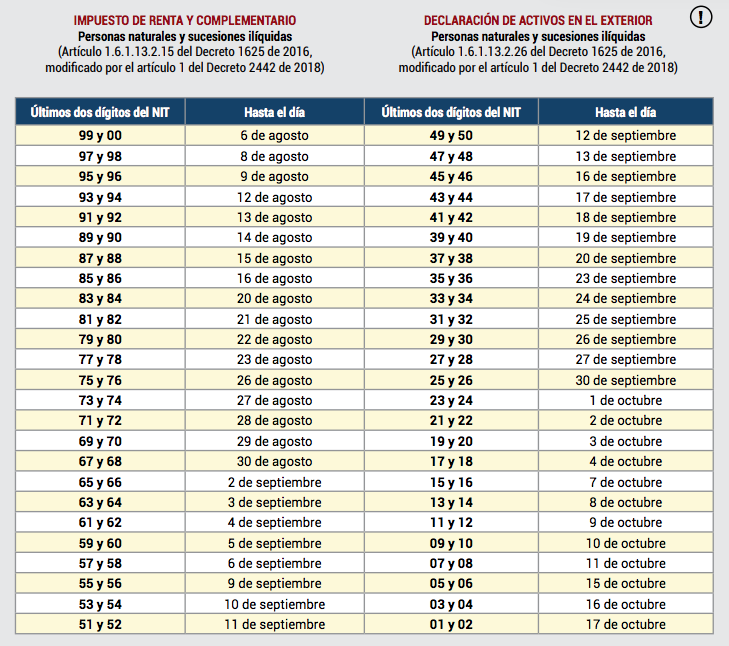

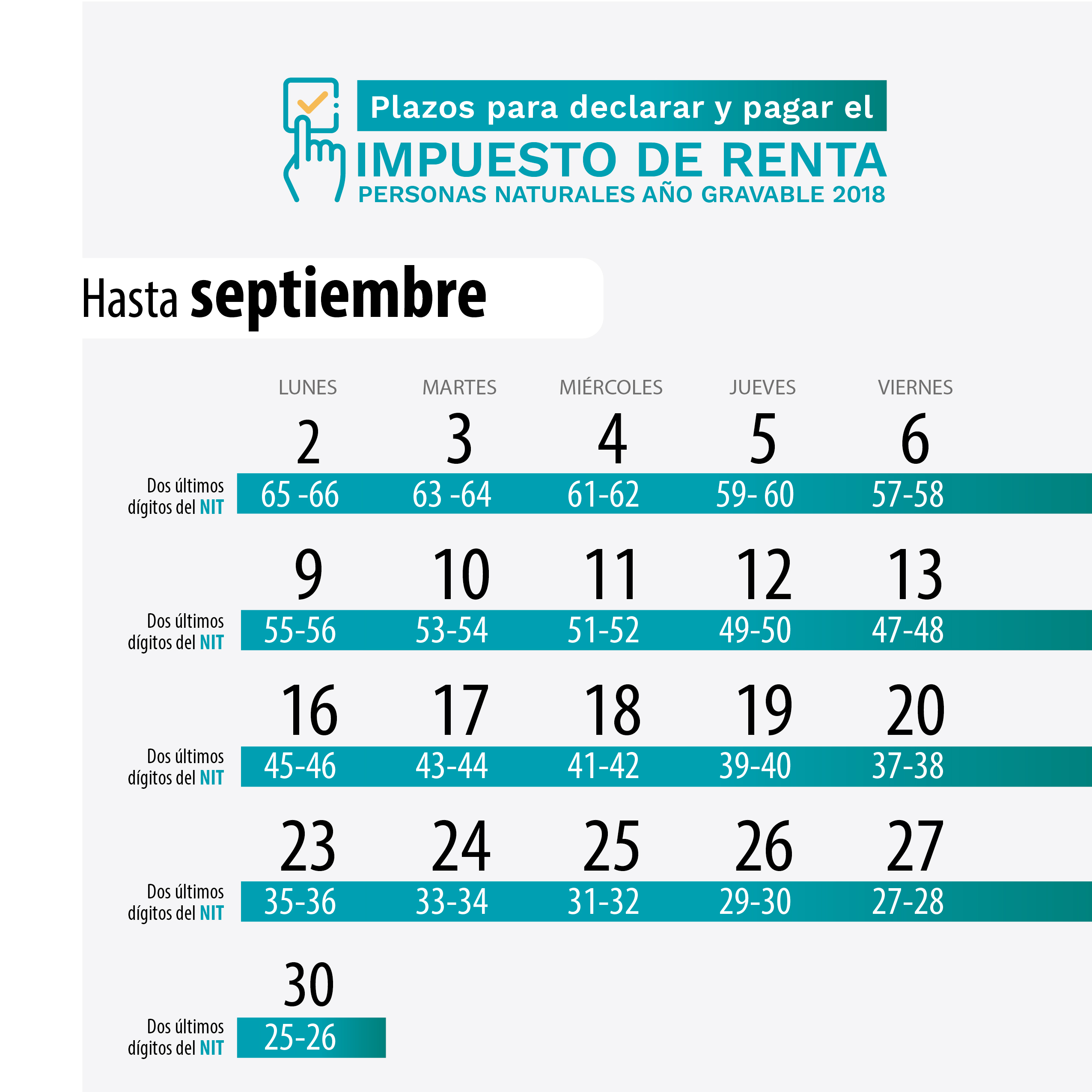

The calendario 2025 renta persona natural is a fiscal calendar that establishes the deadlines and requirements for natural persons to comply with their tax obligations in Colombia for the 2025 tax year. This comprehensive guide provides a detailed overview of the key aspects of the calendario, including important dates, filing procedures, and applicable tax rates.

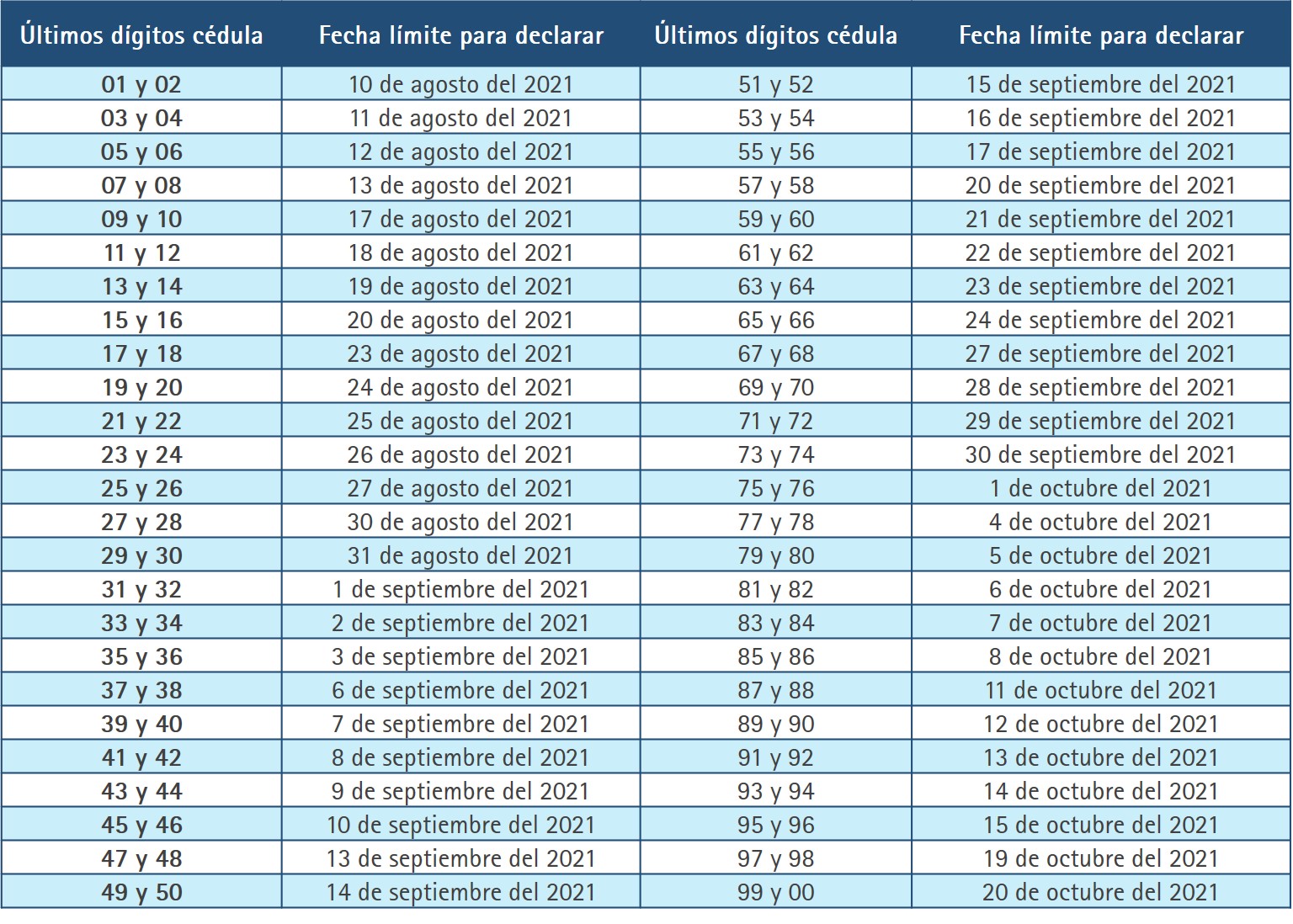

Key Dates

- January 10, 2025: Deadline for filing the annual income tax return (Cédula General) for the 2024 tax year.

- February 28, 2025: Deadline for payment of the first installment of the annual income tax for the 2025 tax year.

- May 30, 2025: Deadline for payment of the second installment of the annual income tax for the 2025 tax year.

- August 1, 2025: Deadline for filing the simplified income tax return (Cédula Simplificada) for the 2024 tax year.

- October 31, 2025: Deadline for payment of the third and final installment of the annual income tax for the 2025 tax year.

- November 30, 2025: Deadline for filing the simplified income tax return (Cédula Simplificada) for the 2025 tax year.

Filing Procedures

Cédula General (Annual Income Tax Return)

- File online through the DIAN website (www.dian.gov.co) using a digital signature.

- File in person at a DIAN office with the completed return and supporting documents.

- Hire a tax professional to prepare and file the return on your behalf.

Cédula Simplificada (Simplified Income Tax Return)

- File online through the DIAN website (www.dian.gov.co) without a digital signature.

- File in person at a DIAN office with the completed return and supporting documents.

Applicable Tax Rates

Cédula General

- Income up to COP 10,048,180: 0%

- Income between COP 10,048,181 and COP 20,096,360: 19%

- Income between COP 20,096,361 and COP 39,040,620: 28%

- Income between COP 39,040,621 and COP 58,080,880: 33%

- Income over COP 58,080,881: 37%

Cédula Simplificada

- Income up to COP 50,831,000: 8%

- Income between COP 50,831,001 and COP 101,662,000: 14%

- Income over COP 101,662,001: 19%

Exemptions and Deductions

Cédula General

- Standard deduction: COP 10,048,180

- Dependent deduction: COP 3,560,720 per dependent

- Health insurance premiums

- Education expenses

- Charitable donations

Cédula Simplificada

- No exemptions or deductions available

Penalties for Late Filing

- Late filing of the annual income tax return (Cédula General): 5% of the tax liability per month of delay, up to a maximum of 100%.

- Late filing of the simplified income tax return (Cédula Simplificada): 10% of the tax liability per month of delay, up to a maximum of 100%.

Additional Considerations

- Natural persons who earn income from multiple sources are required to file a consolidated annual income tax return.

- Individuals with income from abroad may be subject to additional tax obligations.

- Taxpayers should consult with a tax professional for guidance on specific tax matters.

Conclusion

The calendario 2025 renta persona natural provides a comprehensive framework for natural persons to fulfill their tax obligations in Colombia. By understanding the key dates, filing procedures, and applicable tax rates, individuals can ensure timely compliance and avoid potential penalties. It is essential to consult with the DIAN website or a tax professional for the most up-to-date information and guidance.

Closure

Thus, we hope this article has provided valuable insights into Calendario 2025 Renta Persona Natural: A Comprehensive Guide for Natural Persons. We hope you find this article informative and beneficial. See you in our next article!