5-4-4 Accounting Calendar 2025: A Comprehensive Guide

Related Articles: 5-4-4 Accounting Calendar 2025: A Comprehensive Guide

- Calendario Escolar 2025 Quintana Roo: A Comprehensive Guide

- Calendar Of Festivals And Celebrations 2025

- March 2025 Printable Calendar: A Comprehensive Guide To Planning Your Month

- 2025 Calendar Printable UK: Free Download And Organization Essential

- 2025 Calendar With Holidays Printable Canada: Plan Your Year With Ease

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to 5-4-4 Accounting Calendar 2025: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about 5-4-4 Accounting Calendar 2025: A Comprehensive Guide

5-4-4 Accounting Calendar 2025: A Comprehensive Guide

Introduction

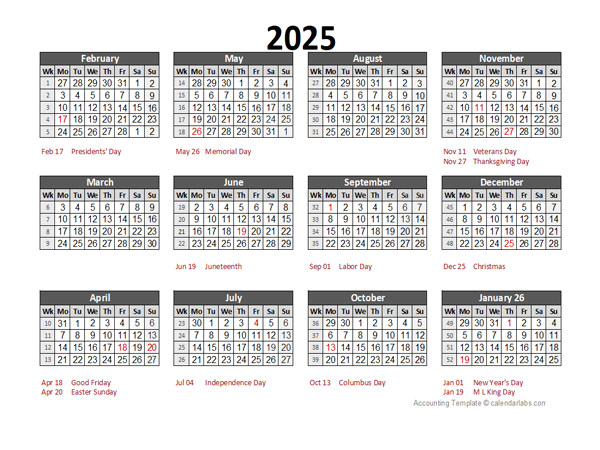

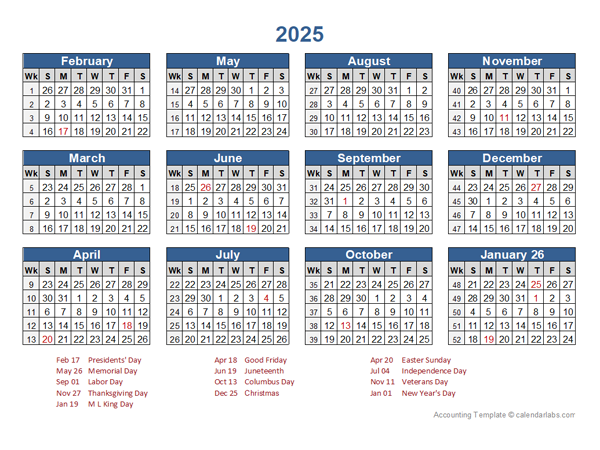

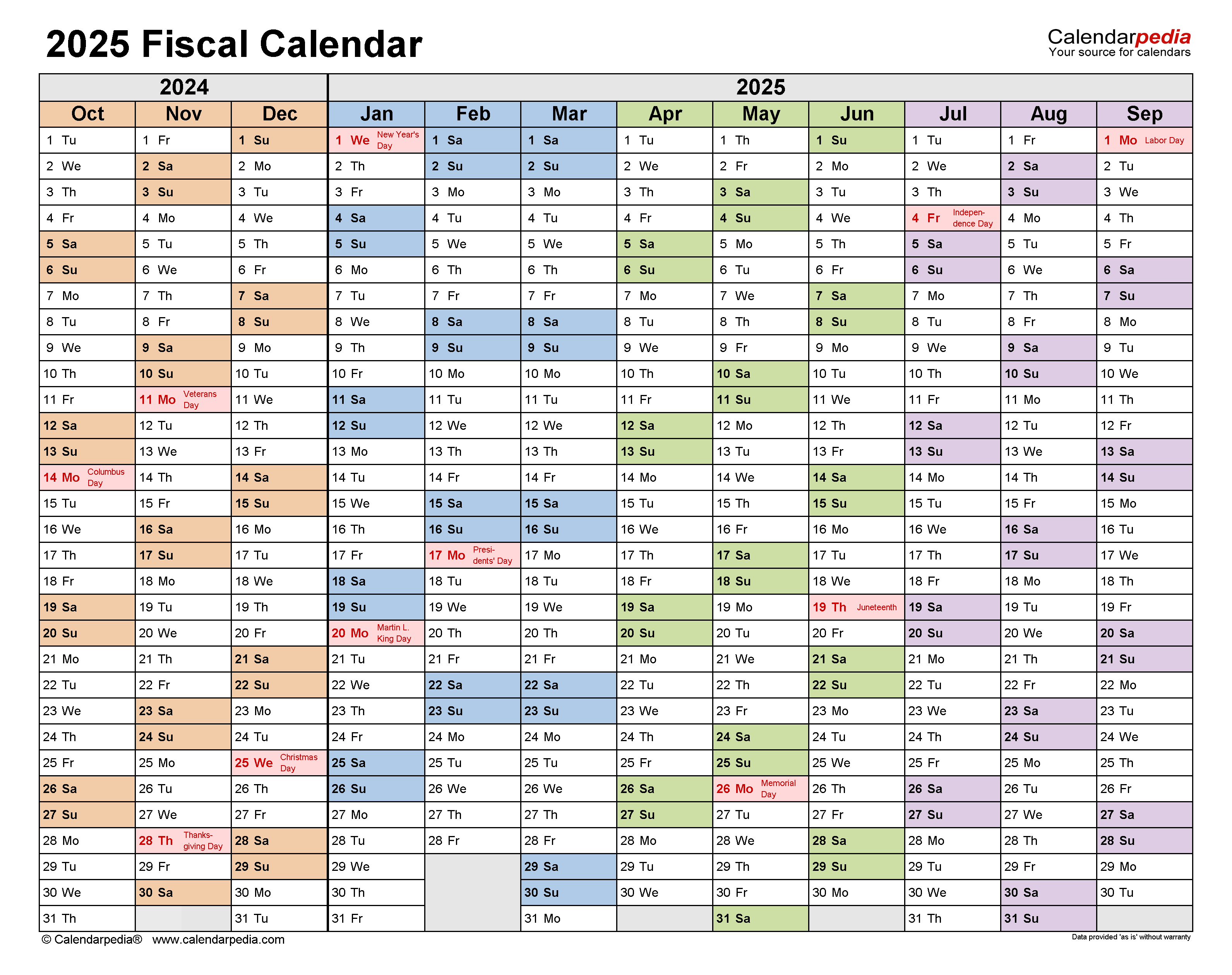

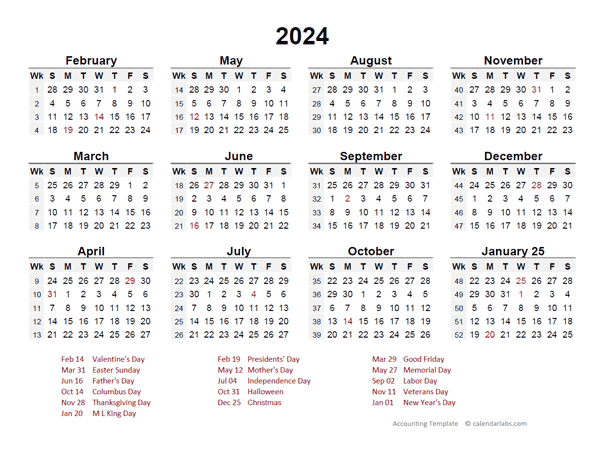

The 5-4-4 accounting calendar is a specialized calendar system designed for businesses and accounting professionals. It offers a unique approach to organizing and managing financial data, providing advantages in terms of accuracy, efficiency, and compliance. This comprehensive guide will delve into the intricacies of the 5-4-4 accounting calendar, exploring its key features, benefits, and implementation strategies for the year 2025.

Understanding the 5-4-4 Calendar

The 5-4-4 accounting calendar follows a structured pattern that divides the year into 13 four-week periods, known as "quarters." Each quarter consists of five weeks, with the exception of the last quarter, which has four weeks. This unique structure allows for a consistent and predictable financial reporting cycle.

Key Features of the 5-4-4 Calendar

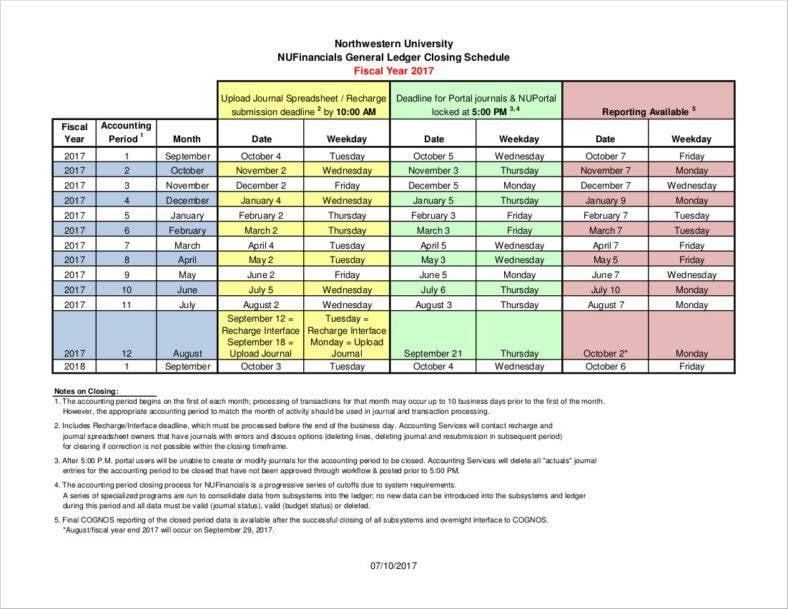

- 13 Four-Week Quarters: The calendar comprises 13 distinct quarters, each spanning four weeks. This regularized cycle simplifies financial reporting and eliminates the need for adjusting entries due to varying month lengths.

- 5-Week Months: Each quarter is further divided into five-week "months." This structure provides a consistent number of business days in each month, ensuring uniformity in financial reporting.

- 13th Period: The 5-4-4 calendar includes an additional 13th period, which consists of four weeks and falls outside the traditional calendar year. This period is used to accommodate year-end closing procedures and financial adjustments.

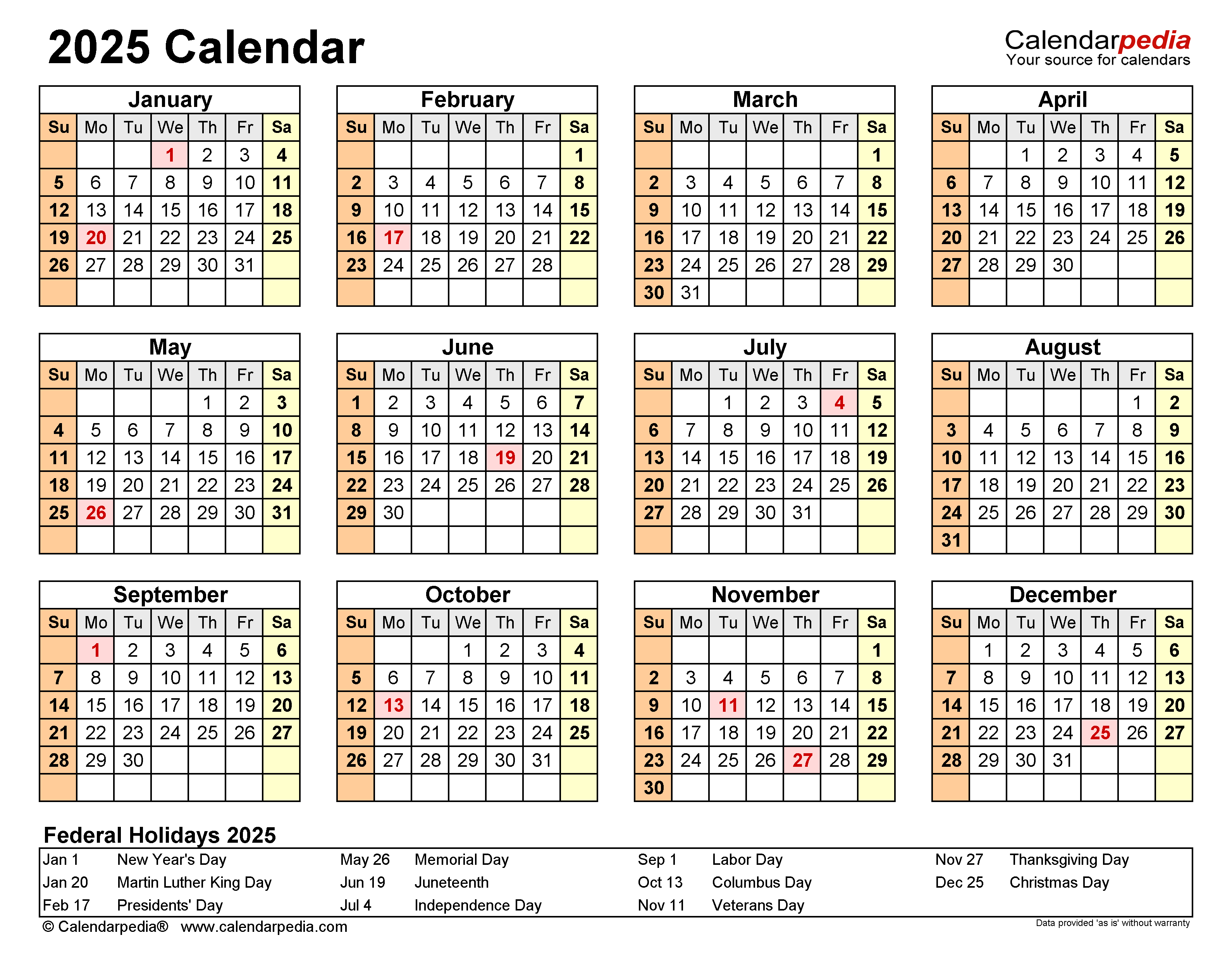

Benefits of Using the 5-4-4 Calendar

- Improved Accuracy: The 5-4-4 calendar’s consistent structure eliminates month-end accruals and estimations, reducing errors and enhancing the accuracy of financial reporting.

- Enhanced Efficiency: The predictable nature of the calendar allows for efficient planning and budgeting, streamlining financial processes and saving time.

- Simplified Compliance: The 5-4-4 calendar aligns with International Financial Reporting Standards (IFRS) and Generally Accepted Accounting Principles (GAAP), ensuring compliance with regulatory requirements.

- Reduced Audit Costs: The accuracy and efficiency of the 5-4-4 calendar can significantly reduce audit costs by minimizing the need for manual adjustments and reconciling entries.

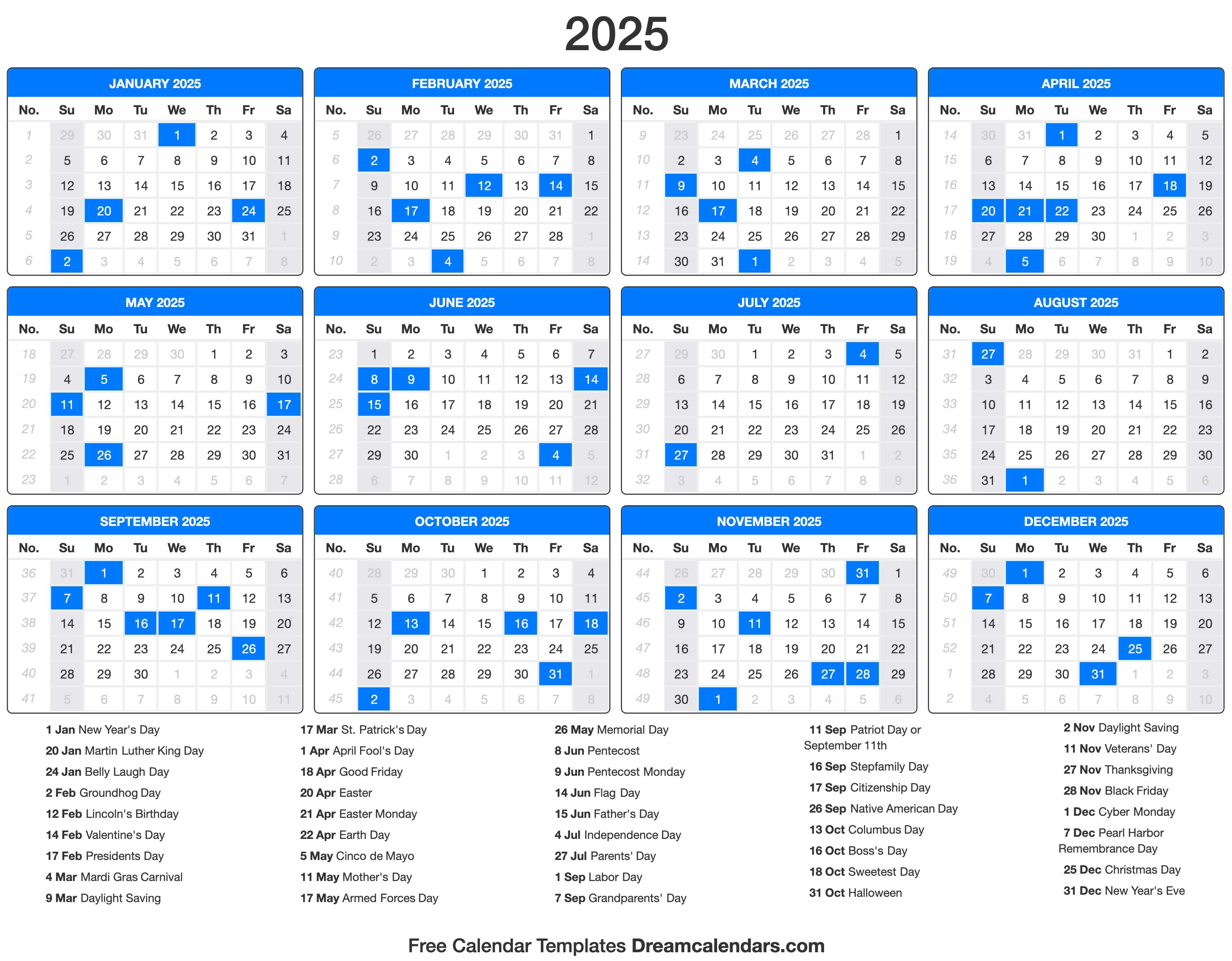

Implementing the 5-4-4 Calendar for 2025

To successfully implement the 5-4-4 accounting calendar for 2025, it is crucial to follow these steps:

- Establish a Conversion Date: Determine a specific date to transition to the 5-4-4 calendar, ensuring minimal disruption to ongoing operations.

- Convert Historical Data: Convert all historical financial data to the 5-4-4 format to maintain continuity and ensure comparability.

- Update Accounting Systems: Configure accounting software and systems to accommodate the 5-4-4 calendar’s structure, including the 13th period.

- Communicate the Change: Inform stakeholders, including employees, customers, and suppliers, about the transition to the 5-4-4 calendar and its implications.

- Monitor and Adjust: Regularly review the implementation process and make necessary adjustments to optimize the calendar’s effectiveness.

Conclusion

The 5-4-4 accounting calendar offers a superior alternative to traditional calendar systems, providing businesses with numerous advantages in terms of accuracy, efficiency, and compliance. By understanding its key features, benefits, and implementation strategies, organizations can harness the power of the 5-4-4 calendar for the year 2025 and beyond. Embracing this innovative accounting tool can significantly enhance financial reporting processes, reduce costs, and improve overall financial management practices.

Closure

Thus, we hope this article has provided valuable insights into 5-4-4 Accounting Calendar 2025: A Comprehensive Guide. We thank you for taking the time to read this article. See you in our next article!