2025 Pay Period Calendar Calculator: A Comprehensive Guide to Calculating Pay Periods

Related Articles: 2025 Pay Period Calendar Calculator: A Comprehensive Guide to Calculating Pay Periods

- November 2025 Calendar For Desktop: A Comprehensive Overview

- 2025 UK Printable Calendar

- Wall Street Calendario 2025: A Comprehensive Guide

- Calendario 2025 Stampabile PDF: Pianifica Il Tuo Anno Con Stile

- Miami-Dade County Public Schools 2025-2026 School Calendar

Introduction

With great pleasure, we will explore the intriguing topic related to 2025 Pay Period Calendar Calculator: A Comprehensive Guide to Calculating Pay Periods. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about 2025 Pay Period Calendar Calculator: A Comprehensive Guide to Calculating Pay Periods

2025 Pay Period Calendar Calculator: A Comprehensive Guide to Calculating Pay Periods

Introduction

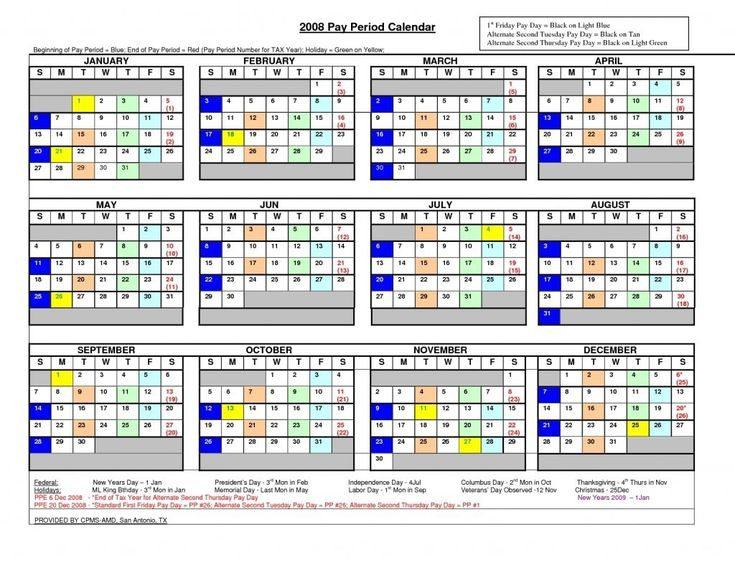

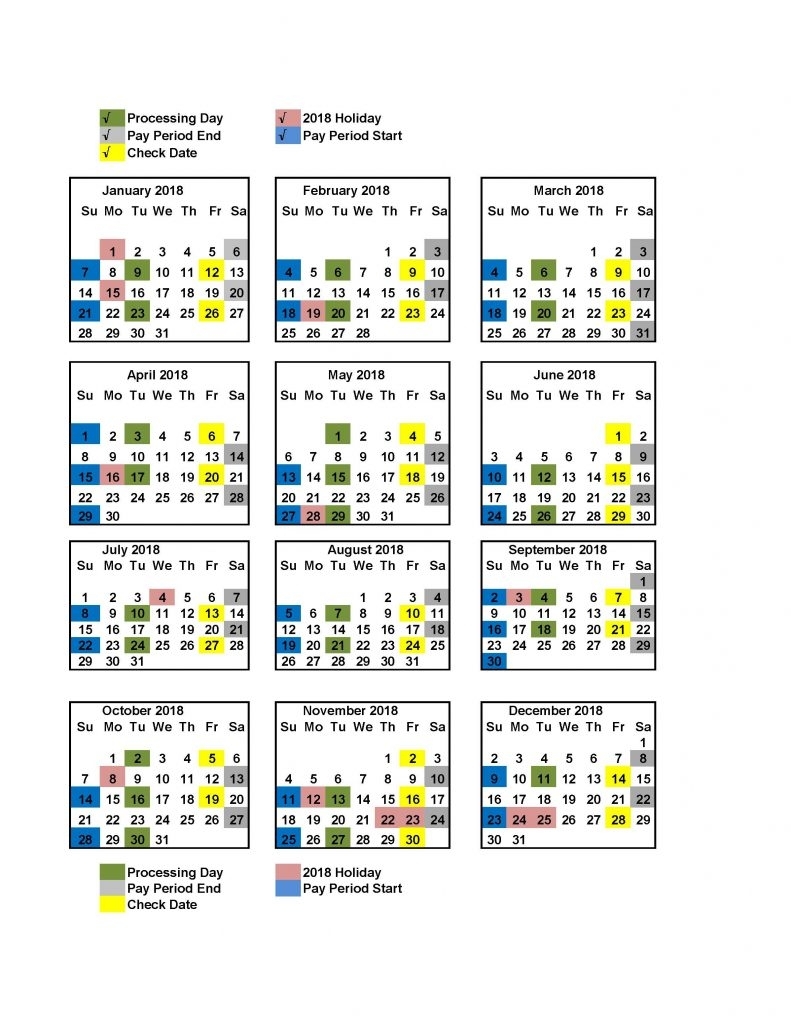

Managing payroll accurately and efficiently is crucial for any organization. A key aspect of payroll processing is calculating pay periods correctly. A pay period calendar calculator is a valuable tool that streamlines this process, ensuring timely and accurate payments to employees. This article provides a comprehensive guide to using a 2025 pay period calendar calculator, including its benefits, features, and step-by-step instructions.

Benefits of Using a Pay Period Calendar Calculator

- Accuracy and Precision: Pay period calculators eliminate manual calculations, reducing the risk of errors. They ensure precise pay period calculations, avoiding overpayments or underpayments.

- Time-Saving: Automating pay period calculations saves time and effort, allowing payroll administrators to focus on other essential tasks.

- Compliance: Pay period calculators help organizations adhere to labor laws and regulations by ensuring accurate payroll calculations.

- Transparency: Clear and detailed pay period calendars improve transparency for both employees and employers.

Features of a Pay Period Calendar Calculator

- Pay Period Frequency: Calculators allow users to select the desired pay period frequency, such as weekly, bi-weekly, semi-monthly, or monthly.

- Start and End Dates: Users can specify the start and end dates for each pay period, taking into account holidays and weekends.

- Holiday and Weekend Exclusion: Calculators automatically exclude holidays and weekends from pay period calculations.

- Paycheck Issue Dates: Users can determine the paycheck issue dates based on the pay period end dates.

- Customizable Settings: Advanced calculators offer customizable settings, such as payroll cut-off times and payroll processing schedules.

Step-by-Step Guide to Using a 2025 Pay Period Calendar Calculator

Step 1: Select Pay Period Frequency

Choose the desired pay period frequency from the available options. Common frequencies include weekly, bi-weekly, semi-monthly, and monthly.

Step 2: Enter Start and End Dates

Specify the start and end dates for the first pay period in 2025. Ensure that the dates align with the chosen pay period frequency.

Step 3: Configure Holiday and Weekend Exclusion

Indicate the holidays and weekends that should be excluded from pay period calculations. This ensures accurate pay calculations for days worked.

Step 4: Set Paycheck Issue Dates

Determine the paycheck issue dates based on the pay period end dates. This information is crucial for timely employee payments.

Step 5: Preview and Print

Once the settings are configured, preview the pay period calendar to verify its accuracy. If satisfied, print the calendar for reference or distribution.

Additional Considerations

- Payroll Processing Schedule: Consider the organization’s payroll processing schedule when setting up the pay period calendar.

- Payroll Cut-Off Time: Establish a clear payroll cut-off time to ensure timely submission of timecards and accurate payroll calculations.

- Legal Compliance: Ensure that the pay period calendar complies with all applicable labor laws and regulations.

Conclusion

A 2025 pay period calendar calculator is an indispensable tool for payroll administrators. By utilizing its features and following the step-by-step instructions outlined in this guide, organizations can streamline pay period calculations, improve accuracy, save time, and ensure compliance. Accurate and timely payroll processing is essential for maintaining employee satisfaction, minimizing errors, and fostering a positive work environment.

Closure

Thus, we hope this article has provided valuable insights into 2025 Pay Period Calendar Calculator: A Comprehensive Guide to Calculating Pay Periods. We appreciate your attention to our article. See you in our next article!